Vehicle depreciation calculator taxes

Total expenses for the truck 7000. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Years 4 and 5 1152.

. Current car depreciation rates show that the value of a new car or truck purchased in 2019 can drop by over 20 over the course of the first 12 months you own the. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. Murray calculates the expenses he can deduct for his truck for the tax year as follows.

This limit is reduced by the amount by which the cost of. 27000 business kilometres 30000 total kilometres x 7000. With this handy calculator you can calculate the depreciation schedule for depreciable property using Modified Accelerated Cost Recovery.

Car Depreciation Calculator. For new or used passenger automobiles eligible for bonus depreciation in 2021 the first-year. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is.

Year 1 20 of the cost. The rules governing depreciation of vehicles can be. Depreciation per year Book value Depreciation rate.

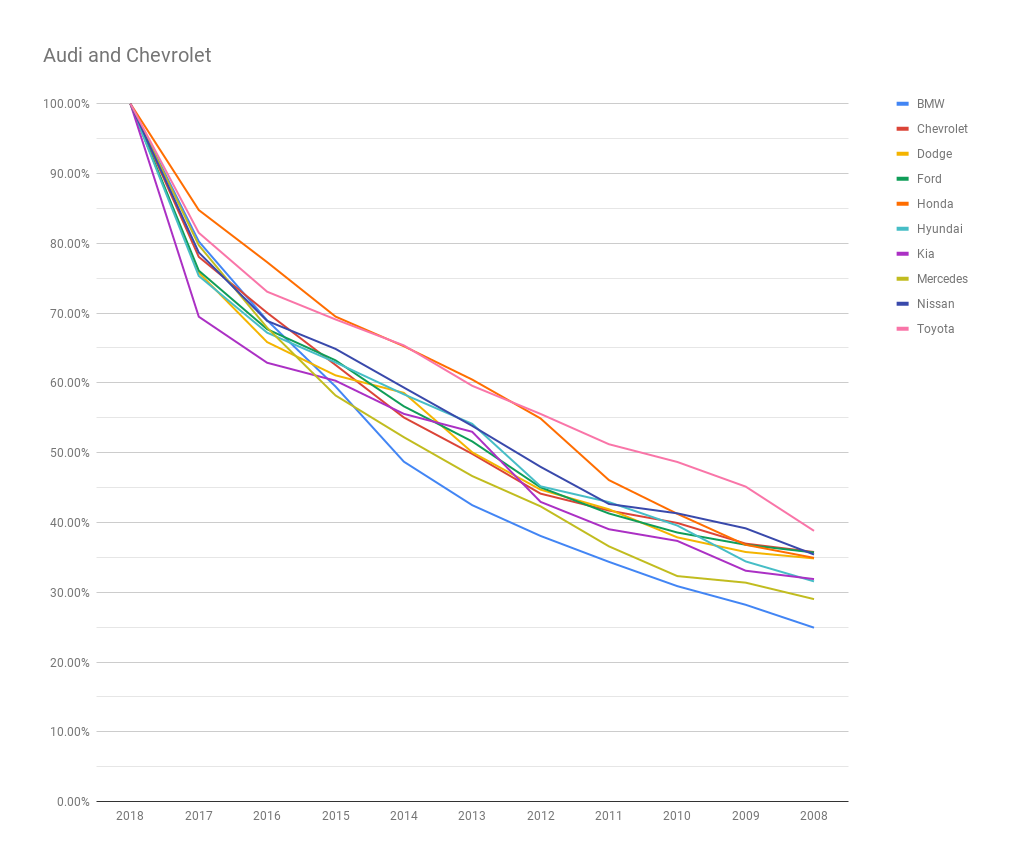

When its time to file your. Depreciation of most cars based on ATO estimates of useful life is. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. We base our estimate on the first 3 year. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

It can be used for the 201314 to 202122 income years. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. 3rd Tax Year 9800.

Use this IRC 168 k federal income tax benefit estimator to see what tax benefits your business could potentially qualify for in 2021. Alternatively if you use the actual cost method you may take deductions for. We will even custom tailor the results based upon just a few.

Prime Cost Method for Calculating Car Depreciation. According to the general rule you calculate depreciation over a six-year span as follows. Each Succeeding Year 5860.

It is determined based on the depreciation system GDS or ADS used. Section 179 deduction dollar limits. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business.

2nd Tax Year 16400. Cost of Running the Car x Days you owned. The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle.

The recovery period of property is the number of years over which you recover its cost or other basis. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. To calculate the depreciation of your car you can use two different types of formulas.

So 11400 5 2280 annually.

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

1

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

1

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Car Depreciation Calculator

When Depreciation Is Your Friend Reasonable Rides

Pin On Insurances

When Depreciation Is Your Friend Reasonable Rides

Free Macrs Depreciation Calculator For Excel

3

Fresh Used Car Sales Near Me Check More At Https Www Toyotasuvsreview Com Used Car Sales Ne Used Cars Used Car Prices Honda Civic Hybrid

Depreciation Calculator Depreciation Of An Asset Car Property

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions